When your Buyer sends you a loan payment each month you’ll need to manually log that payment into the system so that the system can properly calculate the remaining balance of the loan as well as your property tax and HOA/POA escrow account.

- To log a loan payment first click on the ‘Edit‘ link next to the loan Note you would like to apply the payment to.

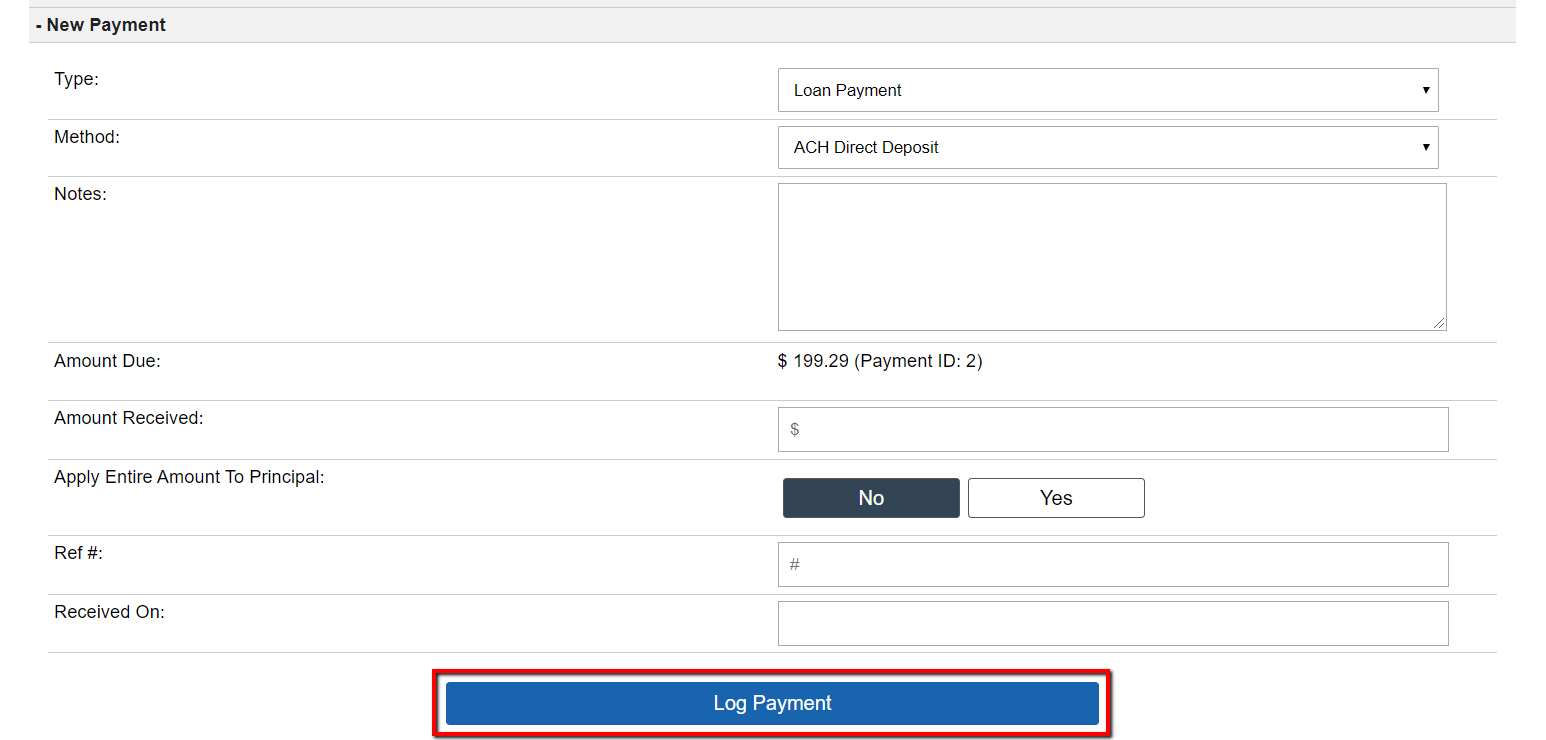

- Under the ‘New Payment‘ section fill out the form and click the blue ‘Log Payment‘ button to record the payment. The form contains the following elements and below is a brief description of each means and how the system uses the information entered under these sections:

- Type: This is where you can select how the payment should be applied.

- Loan Payment: This is a regular monthly payment that includes an interest payment, a principal payment, a tax and HOA/POA impound amount, and your loan servicing charge. NOTE: As long as the Amount Received is the same or greater than the Amount Due you can log this type of payment.

- Principal Only Payment: This is a payment applied directly to the principal of the loan only.

- Fee Payment: This is applied to a pending Late or Returned Check Fee payment.

- Method: Select the payment method that the Buyer sent the funds to you with. Additional Payment Methods can be added to the system under ‘Customize> Notes Settings> Accepted Payment Method‘.

IMPORTANT NOTE: The “Adjustment” ‘Payment Method‘ allows you to essentially write-off a Payment and mark it as paid without actually collecting the funds. - Notes: This is where you can add notes about the payment, or transaction for you to reference in the future.

- Amount Due: This will show the amount due along with the payment or fee reference number associated with that amount that is due.

NOTE: The system will by default apply the payment or fee to the first pending payment that has been assessed to the Note. So if there are multiple pending payments the system will apply money received in the order the payments were originally assessed to the account. - Amount Received: This is the amount that you have received and that you want to apply to that payment specifically referenced.

- Apply Entire Amount To Principal: Selecting ‘No‘ will apply a predefined portion of your payment to interest and to your property tax and HOA/POA escrow log. Selecting ‘Yes‘ will apply the entire amount received to the Principal.

- Ref #: This can be a bank, payment transaction number, or a check number associated with the funds you received from your Buyer.

- Received On: This is the date the payment was received. NOTE: This date affects whether or not a late charge is assessed to the loan.

- Type: This is where you can select how the payment should be applied.

Note: Any overage portion to the payment would be applied to the principal as an extra payment